Otso Monthly - January 2026

Otso Monthly – January 2026

How did we do?

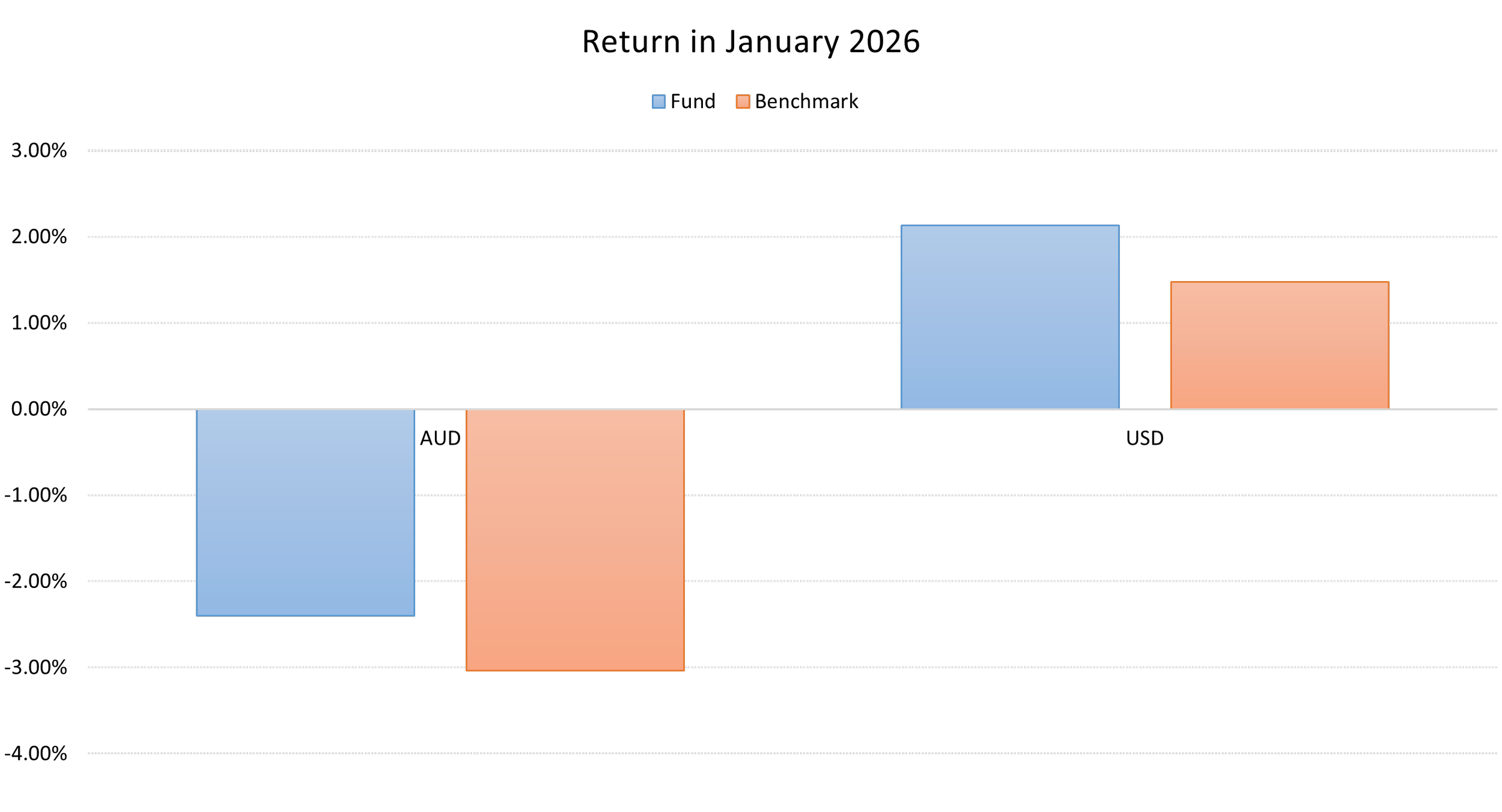

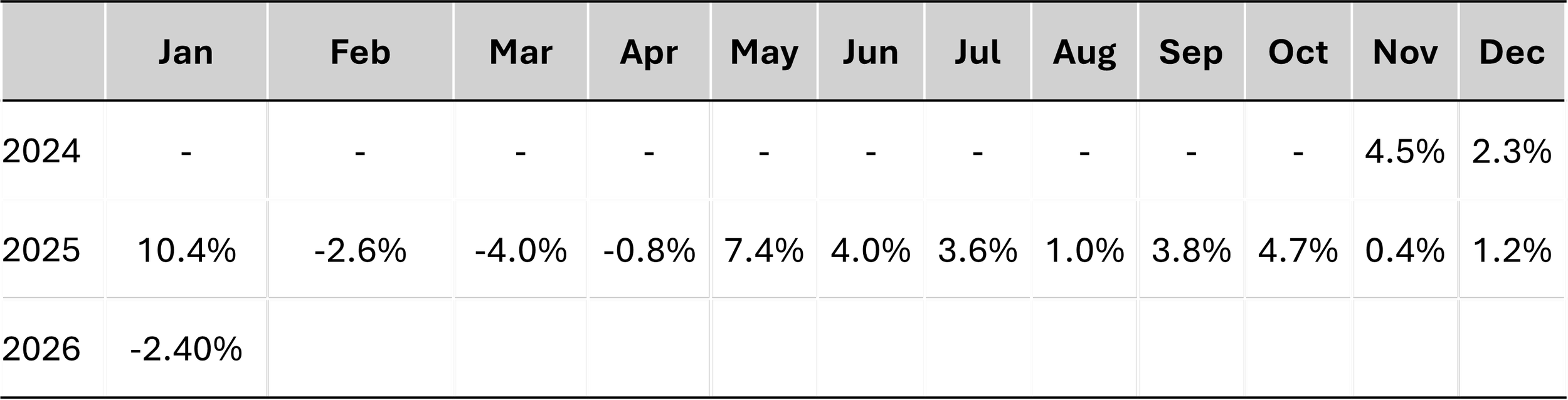

We performed reasonably in January, with a modest outperformance. In USD terms, we achieved 2.15% (vs benchmark of 1.47%). However, the AUD increased significantly in January on the back of anticipation that the Reserve Bank would hike interest rates. Thus, in AUD terms, we delivered -2.4% (bs benchmark of -3.03%).

What happened in January?

US markets opened 2026 with a constructive, but volatile, month. Key considerations included speculation about future Federal Reserve interest rate decisions, the new Fed Chair, scrutiny of tech stocks, and ongoing (if muted) geopolitical issues. However, the strong AUD weighed on returns in AUD terms. The S&P500 briefly crossed the 7000 ‘psychological milestone’. However, this was shortlived, suggesting a degree of resistance at this level, potentially in anticipation of future Fed moves.

Rates and the Fed: “hold,” but the debate sharpened. The Federal Reserve’s January 27–28 meeting delivered a widely expected pause, leaving the target range at 3.50%–3.75% and characterizing activity as expanding at a “solid pace,” job gains as “low,” and inflation as “somewhat elevated.” Importantly for markets, the vote revealed a more active internal discussion: two voters dissented in favor of a 25 bp cut.

That dissent mattered, because it signaled that the Fed’s center of gravity is increasingly sensitive to labor-market cooling—even as policymakers remain wary of declaring victory on inflation. Notably, one of the dissenters had previously supported a 50bp cut; however, suggested that at this point the Fed had already made progress in the easing cycle and a slower easing rate could be warranted.

Jerome Powell’s tenure as Fed Chair is drawing to a close. Currently, Kevin Warsh is the candidate to replace him. While Kevin Warsh had been hawkish in the past, his recent rhetoric has been more dovish. The reaction to his nomination has been mostly positive. However, it is clouded by predictable partisan talking points on either side.

Inflation and macro: progress, but sticky pockets. The key macro release in January was the December CPI print. Headline CPI rose 0.3% m/m and 2.7% y/y, while core inflation was 2.6% y/y. This was slightly cooler than expected and supportive of the “disinflation continues” narrative. Markets reacted as expected: Treasury yields dipped after the release and equity futures steadied, reinforcing the view that the Fed could regain “breathing room” if the trend persists.

On growth and the consumer, January data flow was broadly consistent with an economy that is slowing but not breaking. Retail sales for November beat expectations (released mid-January), pointing to still-resilient demand into year-end. At the same time, the labor market continued to cool: December nonfarm payrolls increased just 50,000, and unemployment edged down to 4.4%, a combination that kept “soft landing” hopes intact while underscoring hiring fatigue.

Earnings and “AI capex” narrative: scrutiny rises. January also marked the heart of Q4 earnings season, with mega-cap tech in focus. Ahead of results, investors increasingly debated whether the next leg of AI-linked gains would be driven by revenues and margins, or weighed down by escalating capital expenditure plans. Reuters noted that the scale of expected AI spending (across Microsoft, Alphabet, Meta, and Amazon) has become “unprecedented,” sharpening investor scrutiny of payoffs and free-cash-flow trajectories. This theme did not derail markets in January, but it reinforced a key 2026 setup: even in a strong tape, leadership can rotate quickly if the market starts discounting “too much spend, too little payoff” risk.

Australia: Australia has two notable issues:

1. Australian interest rates are heading in a different direction to those in the US. In January, the market anticipated the RBA’s February meeting. The strong inflation data raised expectations that the RBA would hike. The inflation itself appears largely driven by excessive government spending. The spending has several underlying problems. It adds to aggregate demand, so is tautologically inflationary. Furthermore, the government is inherently less productive than the private sector. Thus, that demand push is not mitigated by an increase in supply. It eventually hiked by 25bps. This has supported the AUD, causing US assets to fall in value in AUD terms.

2. Australia has been undertaking a review into whether to increase capital gains taxes. This did not directly drive markets in Australia, or the AUD. However, it is a significant concern for Australian investors. We address it below.

Looking forward

At the time of writing, we are at the start of February. Already, we have seen some “interesting” movements in markets.

Broadly, February has been muted thus far. There has been volatility in the S&P500. This is partly attributable to tech stocks. It is also partly attributable to on-going analysis of what Kevin Warsh’s nomination for Fed Chair will mean for financial markets.

Crypto, in which we do not directly invest, nosedived amidst boarder risk off sentiment. The sell-off offers a glimpse into risk management practices. Charlie Munger once said that there is no surer way to go broke than ‘liquor, ladies, and leverage’. And so it is with some crypto investors: they over-levered and needed to sell to cover their losses. This is a cautionary tale for all funds. Excessive leverage can dramatically worsen the impact of a period that a less levered fund could sail through. We always keep this concern in mind when structuring our positions.

We remain constructive on the US. Nothing has changed our view that the US is the preeminent market for growth, capital, and investment. While some pockets of Europe might perform well for tactical or valuation reasons, we believe that European, UK, and Australian markets will lag the US over the long term. This is because the microeconomic settings in the UK/EU/AU are bad. All through countries feature a lack of fiscal discipline coupled with an overbearing government that stymies growth. The US does run large deficits, and accrue large debt, but it is more growth focused, allowing it to grow its tax base and give it a greater cushion should it need to recalibrate. By contrast, the UK/EU/AU only address budgetary issues via higher taxes, which is a drag on the private sector and on growth.

Concerns in Australia

Australia is a significant concern. Given that the fund is an Australian entity, we are extremely concerned about mooted changes to the “capital gains tax discount”. The CGT discount essentially holds that if you hold an asset for more than 12 months, the CGT rate is halved. The government is looking tor educe or eliminate the CGT discount. This is – to be frank – absurd given.

Australia has the highest headline CGT rate (at 47%) in the world. By contrast, Singapore, Hong Kong, UAE, New Zealand, Vietnam (run by the Communist Party) all have CGT rates of 0%. The US also has a 12 month capital gains tax discount. Given that the federal tax rate in the US is 39% (halved to 19.5%, with the long term discount), and only applies to incomes above USD 600k, the tax rate is significantly lower than in Australia.

Australia is looking to make itself more uncompetitive. We encourage you to reach out to your local member to express your concern. Here are some resources and articles that we have prepared to which you can refer them:

· AFR: Hiking CGT is bad for Australia’s economy

· Capital Brief: Hiking CGT will not help the ‘housing crisis’

· Submission to the senate review: Full analysis of why hiking CGT is a bad idea.