Otso Monthly - December 2025

How did we perform

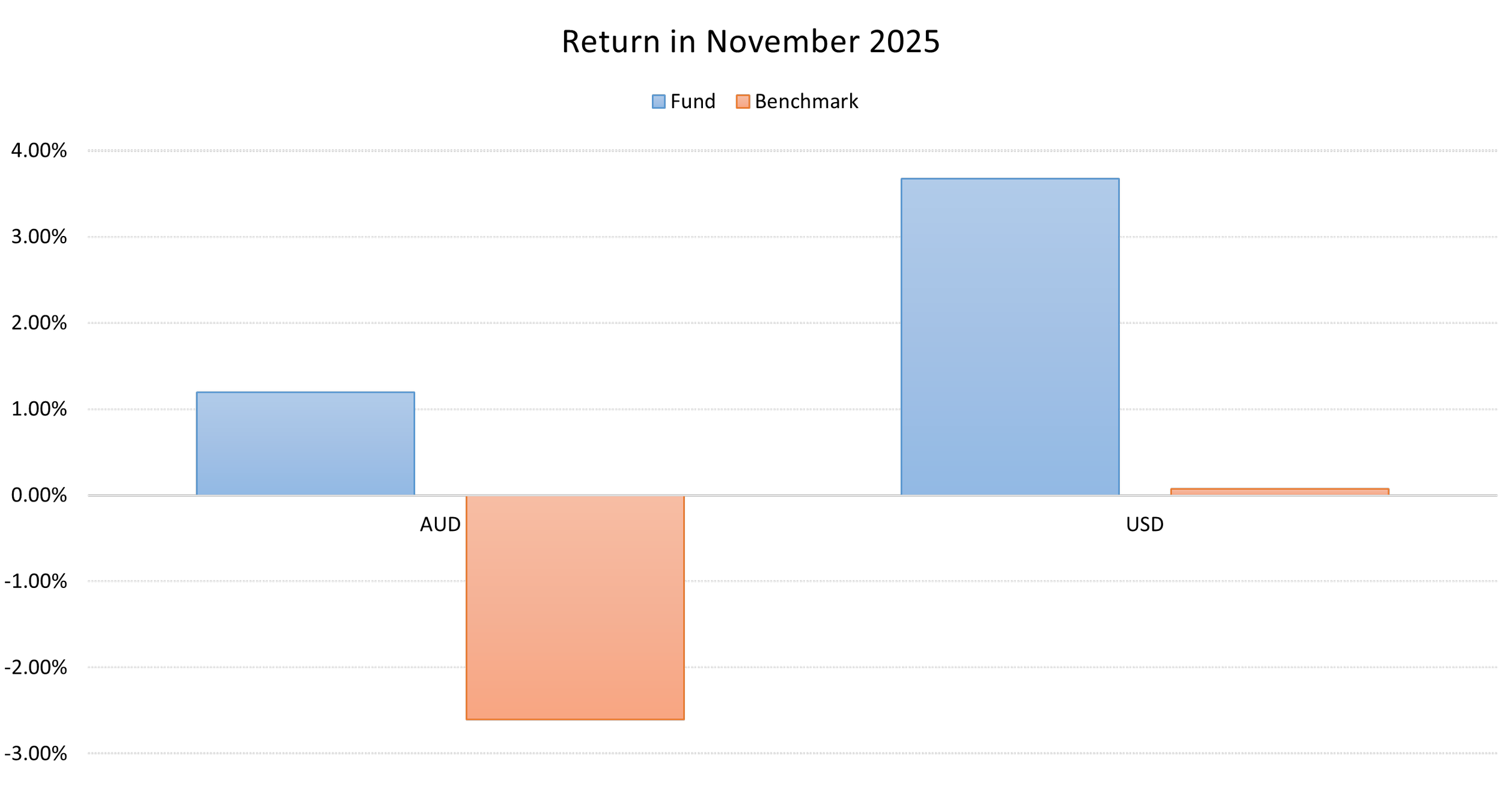

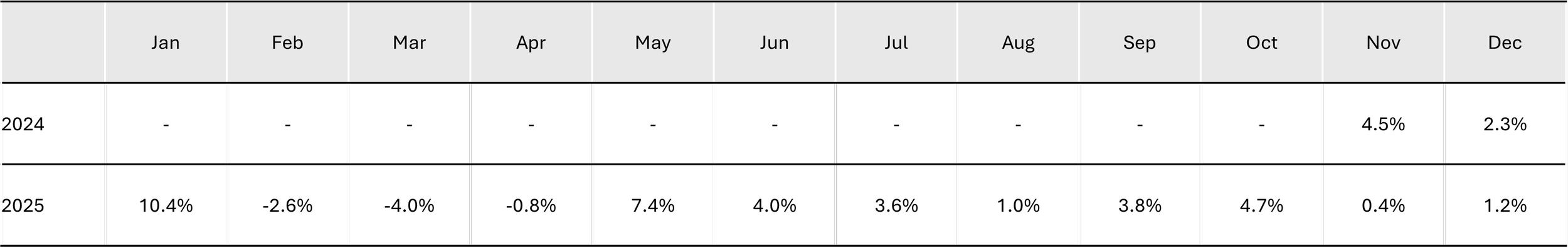

December was a good end to the year. We delivered a return of 3.67% in USD terms (vs benchmark of 0.08%) and 1.19% in AUD terms (vs benchmark of -2.60%). Of course, part of this was due to fund flows, which helped to insulate us from the appreciate in the AUD, and subsequent fall in the AUD value of USD assets. But, nevertheless, it was a good end to the year.

What happened in December

U.S. financial markets finished December 2025 in a “pause that refreshes” mode: equities largely consolidated after a strong year, while rates markets digested a pivotal Federal Reserve cut and a shifting mix of growth and inflation signals.

How the market moved: flat-to-mixed month, strong year intact. The S&P 500 was essentially flat in December (down about 0.05%; SPY was up around 0.08%, at least partly owing to dividends), while the Dow Jones Industrial Average rose about 0.73%; the Nasdaq Composite slipped about 0.5%. Even with the late-year breather, major indexes still ended 2025 with double-digit gains (roughly +16% for the S&P 500, ~+13% for the Dow, and high-teens/around +20% for the Nasdaq, depending on index methodology and rounding).

The AUD appreciated in December. This was at least partly due to the risk that the RBA would further hike interest rates. The increase in the AUD reduced the value of the USD assets, which caused the benchmark to deliver a negative return in AUD terms.

The Fed set the tone with a December rate cut. The key macro event was the Federal Open Market Committee decision on December 10, 2025, which lowered the federal funds target range by 25 bps to 3.50%–3.75%. For equity investors, the cut mattered less as “instant stimulus” and more as a signal that policymakers judged the balance of risks had shifted enough to reduce restrictiveness, while still emphasizing data dependence for what comes next. The updated projections and communications were widely interpreted as a “cut, but not a pre-commitment” message, helping keep financial conditions from easing too dramatically.

December’s bond market story was a mix rather than a one-way rally. In broad terms, the front end (which is most sensitive to expected Fed policy) had room to fall after the cut, but longer-dated yields were pressured by growth and inflation cross-currents. Commentary from major asset managers noted a bull-steepening dynamic (i.e., front-end rates down while longer yields rose), with 10-year Treasury yields up around the mid-teens of basis points over the month. This pattern is consistent with a market that is incrementally more comfortable with the near-term policy path, yet not ready to price a rapid return to very low long-term yields.

Inflation and activity data kept “soft landing” debates alive. Incoming data through the month provided ammunition for both camps. On one hand, inflation remained much cooler than the highs of prior years; for example, reporting released in mid-January showed December CPI up 0.3% m/m and 2.7% y/y (roughly in line with expectations). This supported the view that disinflation was continuing, albeit unevenly. On the other hand, markets also contended with episodes of “hotter-than-expected” activity signals that pushed yields higher and briefly favored cyclicals and value over long-duration growth. A notable example came late in the month, when a batch of stronger growth indicators coincided with an S&P 500 record close around Christmas week.

Geopolitics (here we go again?): Geopolitical tensions did increase in late 2025 and early 2026. For example, on January 2026, the US arrested Nicolas Maduro. Present Trump continued his strident rhetoric against the Federal Reserve, which escalated into a criminal investigation of Jerome Powell. This occurred in January 2026, and has created some fears in relation to Fed independence. Similarly, concerns about Greenland and volatility surrounding tariffs have somewhat shaken markets.

What December means going into 2026. The month’s price action was less about a regime change and more about consolidation after gains. Equities closed the year near highs, but December’s flat results two important sensitivities: (1) the market’s ongoing dependence on the inflation/real-rate path, particularly for long-duration growth; and (2) the potential for leadership to broaden when the macro narrative becomes less one-sided. The Fed appears set to continue the easing cycle. However, the precise magnitude of the cycle will depend on inflation remaining contained. We remain constructive on the US. We see the US as heading on the right path towards lower rates and contained inflation.